Who we are

Legal & General is a leading UK financial services group and major global investor, with sustainable finance and a zero-carbon future at our core. We aim to build a better society for the long term by investing our customers’ money in things that make life better for everyone.

We are one of the world’s largest asset managers and provide powerful asset origination capabilities. Together, these underpin our retirement and protection solutions: we are an international player in pension risk transfer, in UK and US life insurance, and in UK workplace pensions and retirement income.

Assets under management (AUM) in 2023

Return on equity (ROE) in 2023

Target net zero

What we do

We have been safeguarding people’s financial futures since 1836 through our pension services and investments.

We aim to:

- Be a leading provider of retirement and protection solutions.

- Be one of the world’s largest asset managers.

- Be an innovative asset creator.

- Build a more sustainable society.

Legal & General values mean we’re committed to improving the lives of customers, building a better society for the long term, and creating value for our shareholders across all of our businesses. By investing billions of pounds of capital in projects, we aim to make things better: better homes, healthier retirements, prosperous towns and cities. All the while putting our customers first, delivering for our shareholders, and playing our part in tackling the climate crisis.

Our purpose

Our purpose is based on inclusive capitalism, which means improving the lives of our customers, building a better society for the long term and creating value for our shareholders. To do this we invest in real world assets, such as affordable homes, clean energy, and the regeneration of towns and cities.

Here’s how inclusive capitalism works…

Our progress

Take a closer look

Our investments are reshaping Britain’s towns and cities. Explore our map to find out more.

Our strategy

Our strategy is driven by six global growth drivers. In responding to these long-term drivers, we are set to deliver sustainable profits as well as positive social and environmental outcomes.

As populations live longer, their pensions need to last longer, too. Companies increasingly need to find solutions to their ongoing pension commitment, while individuals must ensure that their retirement funds and other assets can finance longer retirements.

Strategic priority: We aim to be global leaders in pensions de-risking and retirement income solutions, building upon success in the UK and US.

Asset markets are increasingly globalised and growing. North America, Asia Pacific and Europe are all attractive markets which continue to expand. We look for selective opportunities to build and expand our successful UK business model abroad into markets where we believe we can thrive.

Strategic priority: We aim to build a truly global asset management business, entering new markets and expanding our existing operations.

Throughout the UK and beyond, there has been a long-term trend of under-investment in major towns and cities, and we continue to experience a serious housing shortage, while small and medium enterprises can also struggle to achieve scale without access to long-term capital.

Strategic priority: By investing capital over the long term, we aim to become leaders in direct investments whilst benefiting society through socially responsible investments.

Changes to the state pension, the switch from defined benefit (DB) to defined contribution (DC) pensions and uncertainty over social care funding highlight the continued need to protect people from financial uncertainty. This includes helping people take personal responsibility for retirement savings, and safeguarding their financial wellbeing and resilience.

Strategic priority: We help people take responsibility for their own financial security through insurance, pensions and savings.

Consumers, clients and businesses look to digital platforms to help organise their finances and working lives. Technological solutions can increase security and improve the ways we work and access information. This can mean the difference between success and failure in business.

Strategic priority: Technology and innovative solutions improve customers’ lives and increase efficiency. We aim to be UK market leaders in the digital provision of insurance, growing in the US and expanding in adjacent markets.

Scientists, policy-makers, markets and regulators increasingly agree that we must limit global warming to 1.5°C to avoid the potentially catastrophic impacts of climate change. This requires a transition to a low-carbon economy, which in turn creates risk management challenges but also substantial new growth opportunities, including in innovative technologies and green energy.

Strategic priority: We are able to support the fight against climate change and zero carbon target through the positioning of our own investments, our influence as one of the world’s largest asset managers and through management of our own operational footprint.

Our business model

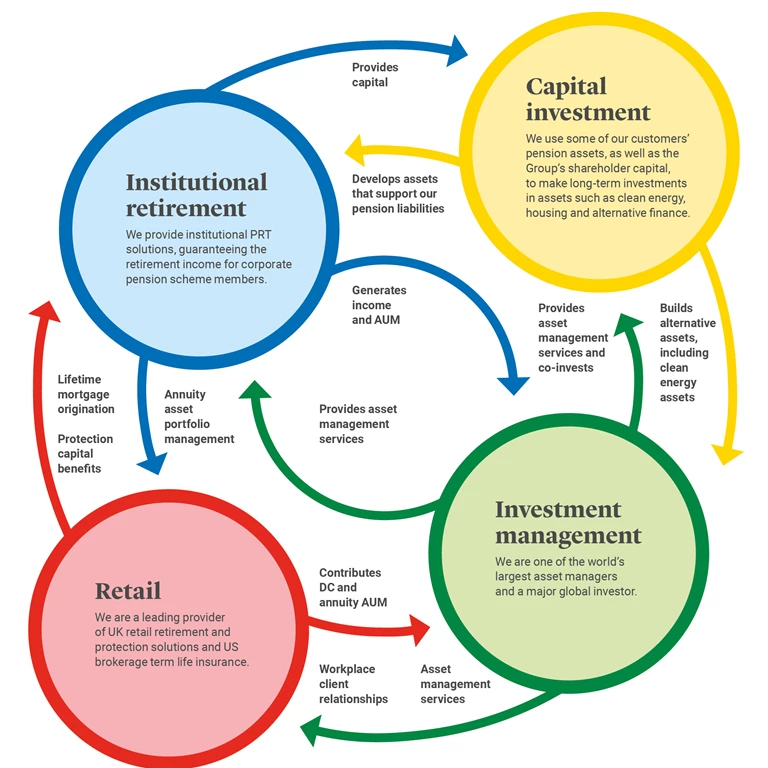

Our model is highly synergistic. Our businesses work together to deliver our strategic purpose and generate value for our shareholders, customers and communities.

Institutional retirement

We provide institutional PRT solutions, guaranteeing the retirement income for corporate pension scheme members.

Capital investment

We use some of our customers’ pension assets, as well as the group’s shareholder capital, to make long-term investments in assets such as clean energy, housing and SME finance.

Investment management

We are one of the world’s largest asset managers and a major global investor.

Retail

We are a leading provider of UK retail retirement and protection solutions and US brokerage term life insurance.

Our business model in a nutshell

Our business model is underpinned by the depth and breadth of our resources, which allow us to deliver on our purpose, execute our strategy, and drive synergies across the group.

As the guiding principle at the heart of the way we make decisions, inclusive capitalism is exceptionally well aligned to our long-term business model. We use capital from our shareholders, customers and clients whose money we manage to invest in the projects and assets that will drive benefit for years and decades to come. These investments generate reliable returns which go towards paying the pensions of our customers and returns for shareholders.

Our history

The Legal & General history is a colourful one. In June 1836, six lawyers founded Legal & General. And that’s just the start… Our aim to build a better society has been present for as long as we have. Passionate in the belief that capitalism and social progress are not opposing forces, we took our first step in regenerating Britain’s towns and cities.

We invested £20,000 in the Stockton and Hartlepool Railway to help keep cities moving, and made our very first investment in property development, in Birkenhead. More than 150 years later, our goal to regenerate cities has resulted in us investing £32bn in towns and cities across the UK.

Click ‘enter’ below to read more about the Legal & General history.