- Retirement income, including annuities

- Lifetime mortgages/equity release

- Retirement financial advice

- Care

- Protection

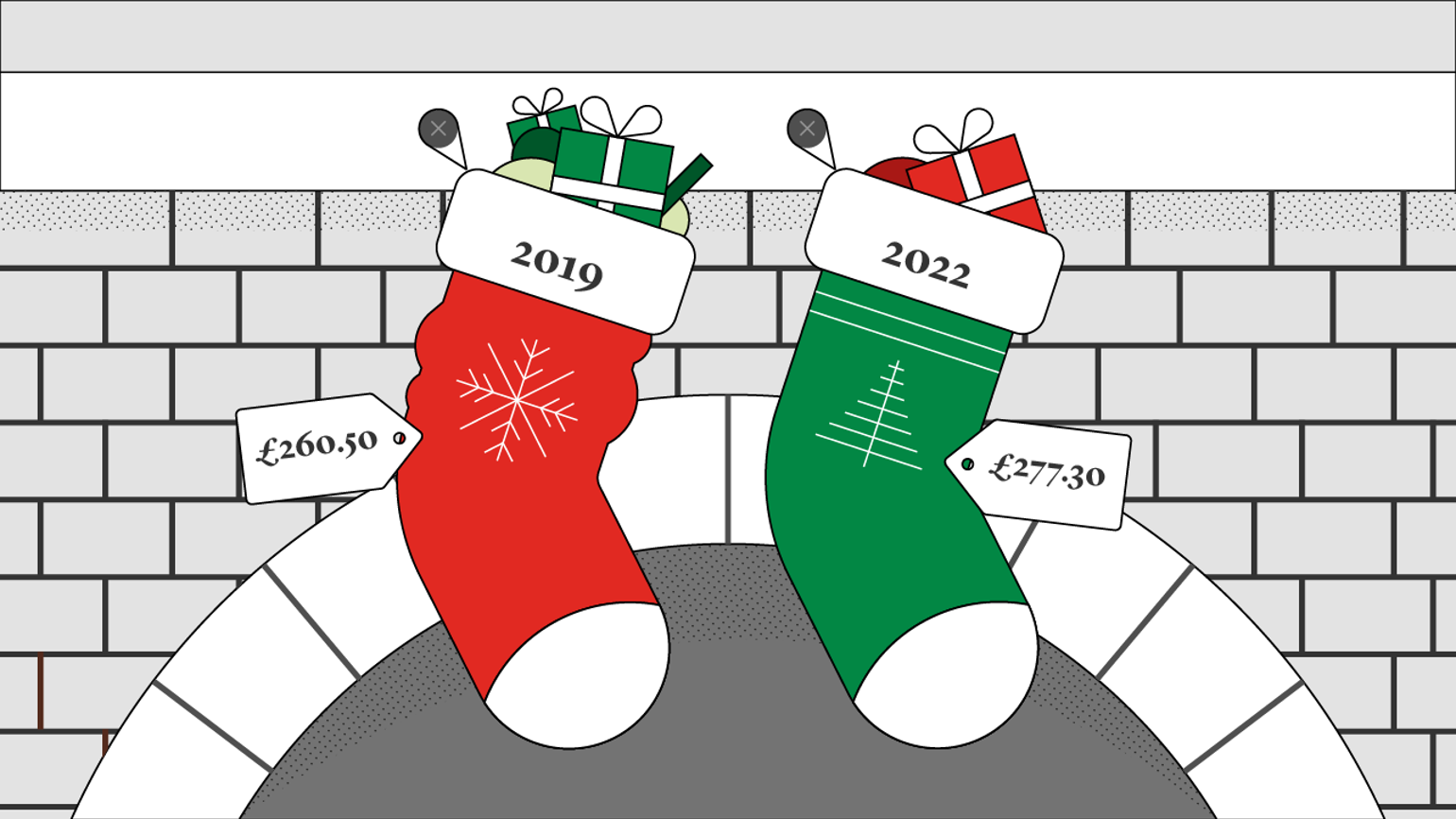

Inflation sets Christmas spending power back a decade as consumers pay more for less

UK households set for average Christmas spend of £560, a near record. Total UK spend on Christmas to hit £15.7 billion, up 7.3% on 2019, but consumers get much less for their money. London households due to spend almost £200 more than those in North East. Households in North East, Wales, and Yorkshire planning smallest Christmas expenses this year.

17 Dec 2022

Full press release

Research conducted by Legal & General, in partnership with The Centre for Economics and Business Research (Cebr), has today revealed that UK households will spend a near record of £560 over Christmas, far more than they did in 2019 while receiving much less due to inflation.

Collectively, UK households will spend £15.7 billion on Christmas festivities in 2022, up 7.3% on 2019 and by 3.6% on 2021.

Note: All figures are calculated in nominal terms.

Christmas spend varies hugely by region

Londoners lead as the biggest Christmas spenders this year, set to generate an average bill of £675.20 per household, closely followed by those in the South East (£660.80), and East (£605.80). Households in the North East are set to spend most modestly with an average festive bill of £486.80 (£188.40 less than those in London), highly comparable with those in Wales (£493.60), and Yorkshire and the Humber (£500.70).

Households in all UK regions will record their highest Christmas spend this year of the past three years.

The Cost of Christmas Per Household, By Region (Smallest to Largest 2022 Spend)

|

2019 |

2020 |

2021 |

2022 |

|

|

North East |

£449.90 |

£363.90 |

£474.20 |

£486.80 |

|

Wales |

£462.20 |

£389.20 |

£478.20 |

£493.60 |

|

Yorkshire and the Humber |

£477.40 |

£377.40 |

£486.30 |

£500.70 |

|

Scotland |

£461.70 |

£384.50 |

£509.00 |

£523.00 |

|

West Midlands |

£473.20 |

£401.70 |

£513.10 |

£527.30 |

|

North West |

£477.50 |

£402.20 |

£514.60 |

£528.50 |

|

East Midlands |

£510.90 |

£427.70 |

£526.10 |

£549.30 |

|

UK |

£527.30 |

£438.60 |

£541.10 |

£556.50 |

|

Northern Ireland |

£438.20 |

£378.50 |

£550.30 |

£562.80 |

|

South West |

£555.50 |

£454.80 |

£581.60 |

£597.40 |

|

East |

£547.50 |

£453.20 |

£589.40 |

£605.80 |

|

South East |

£629.40 |

£527.00 |

£643.40 |

£660.80 |

|

London |

£633.50 |

£530.10 |

£651.80 |

£675.20 |

Real terms hit to expenditure

With the current Consumer Price Index measure of inflation up by 10.7% since this time last year, households will have to contend with the rising price of both essential and luxury goods. For households to have the same Christmas as they did in 2019, purchasing the same goods in the same quantities, this would now cost them an average of £620. This is £90 more than they spent in 2019 and £60 greater than their expected nominal spending this year.

Despite a 11.5% increase in expenditure on food and drink, households will have a smaller Christmas meal this year

Food and non-alcoholic beverages eat up the most budget at Christmas and will likely put the biggest strain on household finances over the festive period. While households spent £110 eating and drinking at home in 2021, the rises in inflation will cause average spending to exceed £120 in 2022, an increase of 11.5%. Consuming the same amount of food as 2019 will cost £20 more.

The cost of giving

According to the research, Christmas spending across gifting categories is set to be down on 2019 levels. Households are spending less on communication, personal care, clothing, and footwear gifts. This is in spite of widespread price rises, suggesting households are making significant cutbacks on gifts this year.

The lower figures are also notable in the context of the pandemic. For many, 2022 may be the first big ‘family’ Christmas since 2019. However, ballooning inflation may mean some families will either downscale their plans or spend more to enjoy their traditional Christmas.

The total trends in Christmas costs for the average household since 2019 are summarised below.

The Cost of Christmas Over the Years

|

Year |

Games, toys and other Christmas spending |

Food & non-alcoholic drinks |

Household goods & services |

Clothing & footwear |

Alcoholic drink & tobacco |

Technology |

Totals |

|

2019 |

£260.48 |

£115.98 |

£66.29 |

£42.50 |

£23.13 |

£18.88 |

£527.25 |

|

2020 |

£220.20 |

£94.56 |

£54.34 |

£34.05 |

£19.58 |

£15.91 |

£438.64 |

|

2021 |

£280.92 |

£111.55 |

£66.19 |

£40.35 |

£23.31 |

£18.73 |

£541.06 |

|

2022 |

£277.26 |

£124.37 |

£69.67 |

£42.28 |

£23.78 |

£19.13 |

£556.48 |

Bernie Hickman, CEO, Legal & General Retail: “This Christmas families are spending more, but getting much less, due to rising inflation. It's understandable that people want to celebrate together after a challenging few years but, with inflation forecast to continue into 2023, this might not be the only Christmas where people need to tighten their belts.“It’s important people feel able to get together and to celebrate, but this needs to be in a way that doesn’t blow the budget and cause financial issues further down the line. Our online hub, which includes an interactive financial safety net tool, is full of insights and advice to help people strike the right balance with their festive spending.”

Legal & General, and its employees, are supporting a number of organisations that are making a real difference to communities during the Cost of Living Crisis. The company’s festive giving campaign will see more than £250,000 being shared between charities including Citizens Advice, Age UK, SANE, and the Trussell Trust.

Methodology

‘Christmas spending’ in the Cebr report describes additional household spending in November and December, over and above households’ regular month-to-month spending.

Regular monthly spending is taken to be the average spending across the other months of the year, from January to October.

This only considers retail spending, and so does not account for other sources of additional expenditure during the festive period, for instance, higher spending in hospitality venues.

Several adjustment measures were used to account for the impact of the pandemic on retail activity in 2020 and 2021.

Real terms values are expressed in constant 2019 prices throughout. Nominal values are expressed in current prices for the particular reference year.

Christmas expenditure in 2022 is a nowcast taking into account Cebr’s forecasts for the retail sector, inflation, and wider consumer activity.

Further information