Introduction

L&G has been around for 188 years, and throughout our history we have not shied away from actively trying to tackle some of society’s biggest challenges. Climate change, and the twinned crisis of nature loss, require long-term commitments as well as action today. This aligns with our purpose: we are ‘Investing for the long term. Our futures depend on it’.

We play an active role in addressing the risks posed by climate change because we believe it is the right thing to do for our business; creating value for shareholders and protecting our long-term sustainability, while also being better for society and the planet.

Journey to net zero

What does 2050 look like for L&G, and how are we taking steps to get there? Watch below to find out more.

Looking back at 2024

In delivering sustainable growth, sharper focus, and enhanced returns for our shareholders, we continue to address climate change and nature loss using our three-pillar approach: invest, influence and operate.

Take a look at some of our key highlights from 2024 across these three strategic pillars below.

Invest

Reduction in investment portfolio economic GHG emission intensity (%)

37%

Implied temperature alignment

2.5°C

Investments in transition finance (£bn)

£4bn

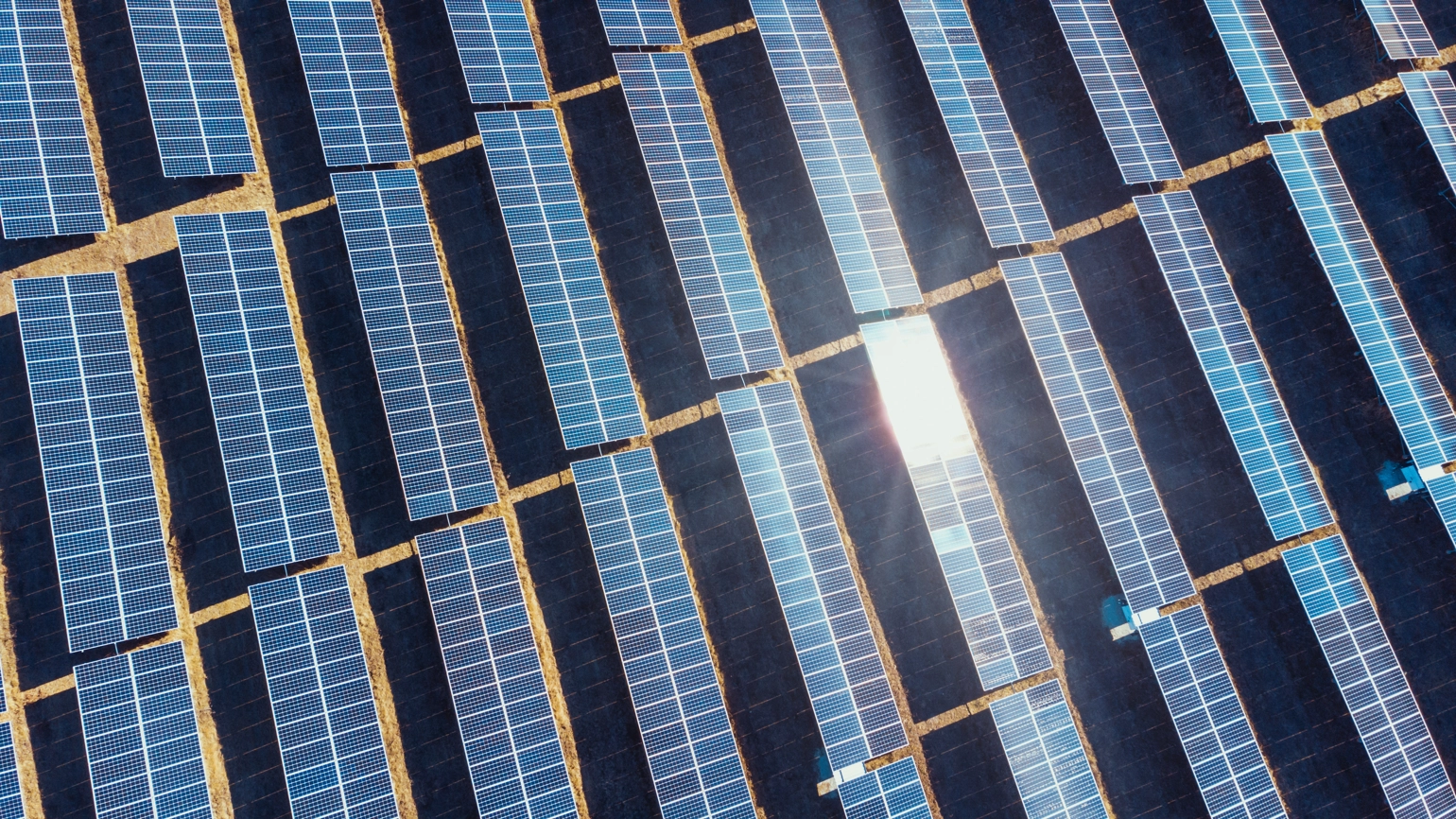

L&G Clean Power (Europe) Fund

The European energy transition represents an €850 billion opportunity for investors to deploy capital into sustainable infrastructure. While Europe has made significant progress, with frameworks in place to continue supporting strong renewables build-out across key markets, but grid capacity needs to be doubled if Europe is to meet its targets.

In 2022, we launched this Fund alongside our partners, NTR. The Fund raised €390 million in committed capital and co-investment opportunity in its first close, using third-party capital, as well as our own. As at 31 December 2024, the Fund holds ten assets representing c.750 MW of wind and solar renewable energy generation and storage.

Influence

Reduction in carbon intensity of occupier energy use across real estate equity assets (%)

30%

Total emissions attributable to our AUM covered by our Climate Impact Pledge (%)

82%

Number of environment-specific engagements

3,617

L&G Climate Action Fund

Companies which are underperforming on the energy transition, may miss out on the opportunities created by it, and are at risk of financial loss if they do not adjust their trajectory. This provides an investment opportunity in global equities, where our analysis indicates there is a value case for them to accelerate their transition.

Our Climate Action Fund aims to capture these opportunities. Building on our existing internal research and modelling capabilities within our investment teams, as well as using our investment stewardship function, who harness engagement with the purpose of unlocking long-term shareholder value and a positive climate impact.

Operate

Reduction in operational footprint (scope 1 and 2 (location)) (%)

30%

Percentage of electricity procured from renewable sources (%)

86%

Percentage of suppliers, by spend, who have a science-based carbon reduction target (%)

68%

SureStore York

One of our industrial funds developed a 36,000 sq ft self-storage facility in York. To target low embodied upfront and operational carbon from early-design stage and to meet energy usage intensity targets, a Whole Life Carbon Assessment was conducted to align with the Fund’s strategy and our Net Zero Carbon roadmap.

The development achieved best-in-class sustainability credentials by generating on-site renewable power, and future-proofing battery installation. The project is projected to enhance income returns and capital growth and outperformed several industrial benchmarks for both embodied and operational carbon.

Our Climate and Nature strategy

Our Group Climate Director, Carl Moxley, explains why addressing climate change and conserving nature have long been integral to our strategy. L&G has an important role to play for our shareholders, customers and society.