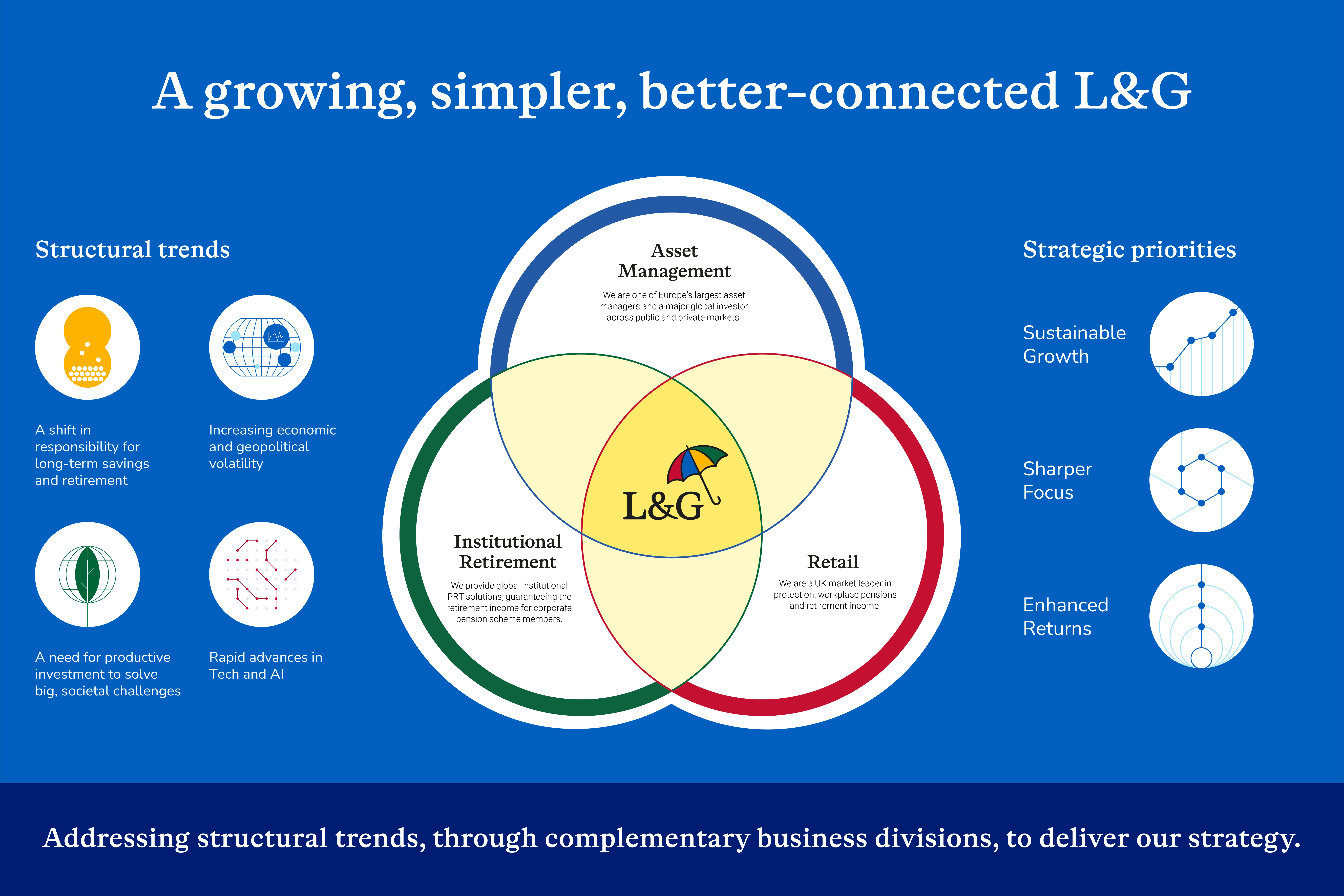

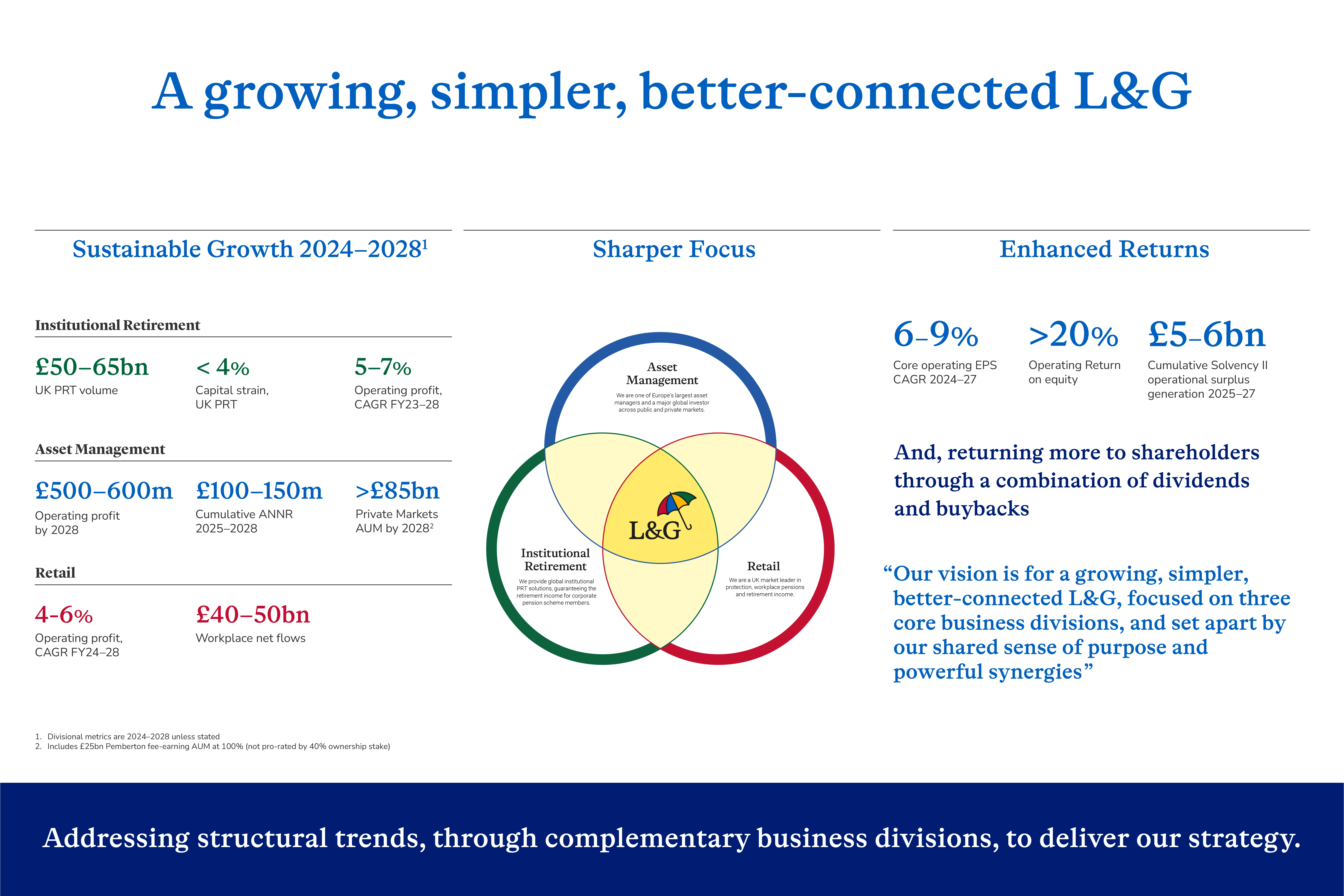

Sustainable growth

Each of our businesses will play an integral role in the future of L&G.

We will continue to grow our Institutional Retirement business, securing the benefits of millions of DB pension holders, funding the production of socially valuable assets, and delivering reliable capital flows for Group for years to come.

We will create a single Asset Management business – which brings together LGIM and LGC – as our critical long-term growth engine: scaled, international, working deeply across public and private markets to provide complex, responsible investment solutions and opportunities.

And, in our Retail business, we will strengthen our propositions to partner with customers throughout their lifetimes, helping them save, protect, plan for, and ultimately enjoy retirement, starting from the day they enrol in their workplace pension scheme.

Sharper focus

Bringing LGIM and LGC together as a single Asset Management business recognises the evolving needs of our clients and partners. We’ll combine our strength and heritage in public markets, and deep asset origination expertise in growth sectors, with our international distribution and product development capabilities, to create new blended propositions and investment opportunities. We have also established Corporate Investments Unit to oversee assets and businesses that are not a strong fit with our refreshed strategy, although some deliver strong financial performance.

Enhanced returns

Our new strategy seeks to deliver strong returns over time, through making the most of our synergies, investing in the business for long term growth, and returning capital to shareholders through dividends and share buybacks.

On 12 June we announced that we plan to increase returns to shareholders, starting with a £200m share buyback this year.

The Board also confirmed that it intends to increase the dividend by 5% for Half Year 2024, and Full Year 2024 (payable in September and June). From Half Year 2025, it intends to grow the dividend at 2% annually, for the next three years, and undertake further buybacks.

António Simões on our strategy

Listen to António explain our vision for a growing, simpler and better-connected L&G, continuing to build on our shared purpose, to benefit our customers, society and shareholders.

Summary of our strategy

We are focusing and simplifying our business, mapping our capabilities to the most compelling near-term market opportunities, and building for long term growth.

Strategy - at a glance

Our new strategy demonstrates our ambition and commitment to invest to grow our business. By seizing the opportunity in Institutional Retirement while investing to scale and deepen our capabilities in Asset Management and Retail, we will evolve our business to better address society’s changing investment needs, and shift towards fee-based earnings at higher returns on capital.

Capital Markets Event on 12 June 2024

On 12 June 2024, we updated the market on Legal & General’s refreshed strategy. Our vision is for a growing, simpler, better-connected L&G, focused on three core businesses, and set apart by our shared sense of purpose and powerful synergies.