Legal & General launches tech tools for workplace pensions to drive member engagement

Pension providers will now have a consolidated data set from which to identify trends, such as employee’s pension contributions, and respond accordingly with targeted communications and “nudge” techniques.

11 Sept 2019

Press release (PDF 260KB)

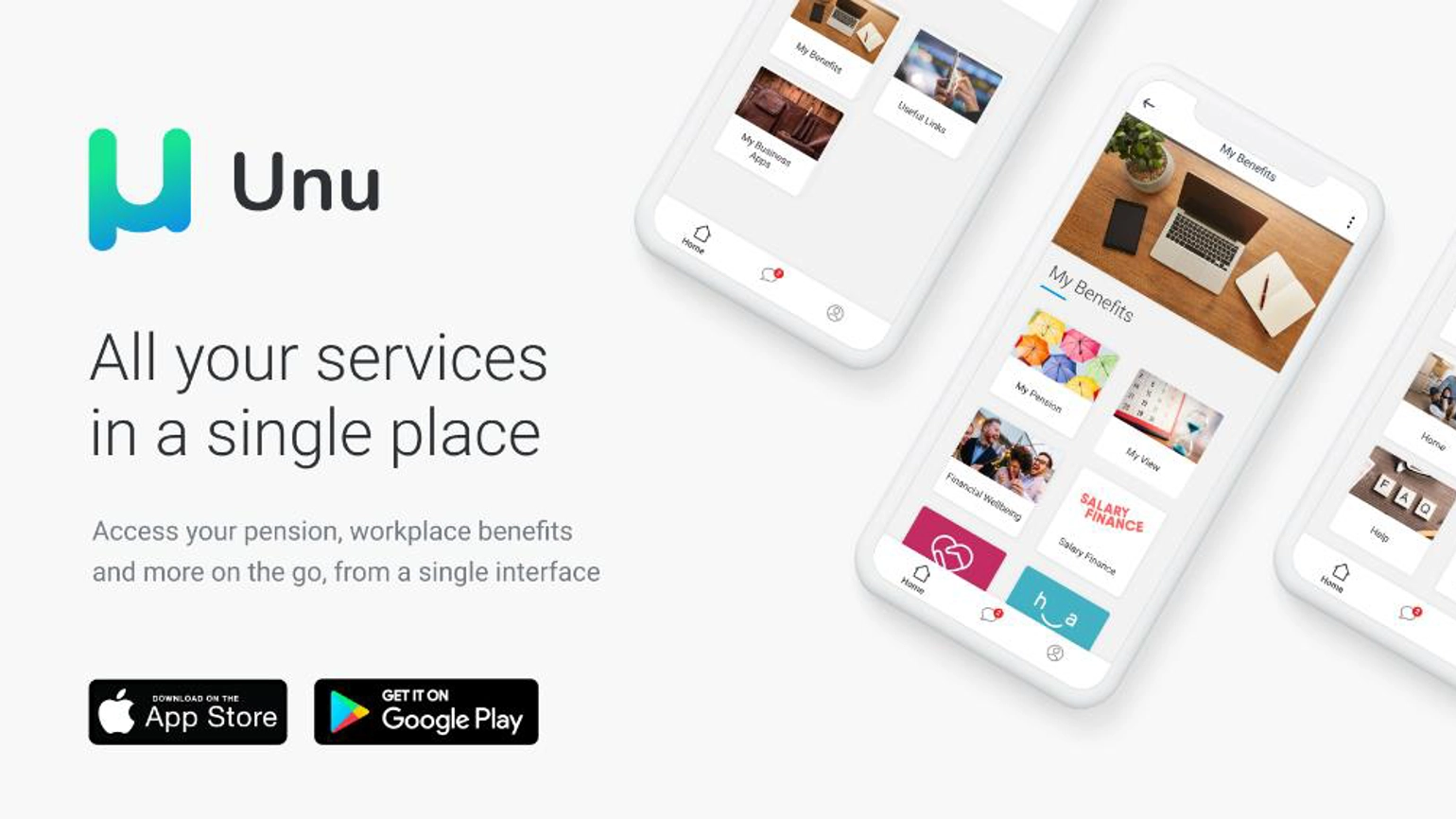

- A member app called 'Unu' gives employees real-time access to employee benefits information, including their pension, as well as other applications through a single login

As one of the UK’s biggest pension providers, LGIM will also be able to draw on a large data set to help give an overview of the UK pensions landscape. This has multiple applications including developing market projections, using business intelligence derived from machine learning and artificial intelligence insights, and influencing broader pensions policy. At an LGIM institutional client conference yesterday, two-thirds (66%) of respondents said data science was an important contributor to improving pension outcomes for workplace savers.

Emma Douglas, Head of Defined Contribution at LGIM: "The tech tools we are launching will help pension providers gain insight into their members’ saving trends by unlocking the wealth of information available in their schemes - such as demographic and regional savings trends, and gender biases... Unu is designed to reduce the amount of time we all spend wading through multiple platforms and information sources."