- Retirement income, including annuities

- Workplace pensions

- Personal investing

- Protection

How much money do you need to make you happy? The happiest retirees have £222k in their pension pot

For the first time, the exact amount of money that you need for a happy retirement has been calculated.

9 Oct 2024

Full press release

- UK retirees with an income of £1,700 a month are the most likely to be happy in their later-years, according to a new report from Legal & General and the world-leading Happiness Research Institute, an independent Danish think tank focusing on wellbeing, happiness and quality of life

- But only a third of UK retirees – four million people (38%) – have this level of income or above

- For savers to reach this level of income, Legal & General estimates contributions must increase from the current default of 8% to a minimum of 10%

The happiest retirees have an average monthly income of £1,700, according to a new study from Legal & General and the world-leading Happiness Research Institute, an independent Danish think tank focusing on wellbeing, happiness and quality of life1. This equates to a pension pot of roughly £221,858 at retirement, providing an income of approximately £20,400 a year2 (which includes a full State Pension).

The Happiness Research Institute builds on measurement guidelines and benchmarks from the Organisation for Economic Co-operation and Development (OECD) and United Nations (UN) to measure people’s happiness. The report, produced in partnership with Legal & General, studied the lives of 3,000 retirees, to explore multiple wellbeing measures of people in later-life such as social connections, health and income to analyse the role money plays in a happy retirement.

It found that only 38% of retirees receive a monthly income of £1,700 or more, while a significant number live on much less.

In fact, one in five retirees (22%) live on less than £1,000 a month, falling below the Pensions & Lifetime Savings Association's (PLSA) minimum standard for covering essential costs in later-life (£1,200 a month, £14,400 annually).

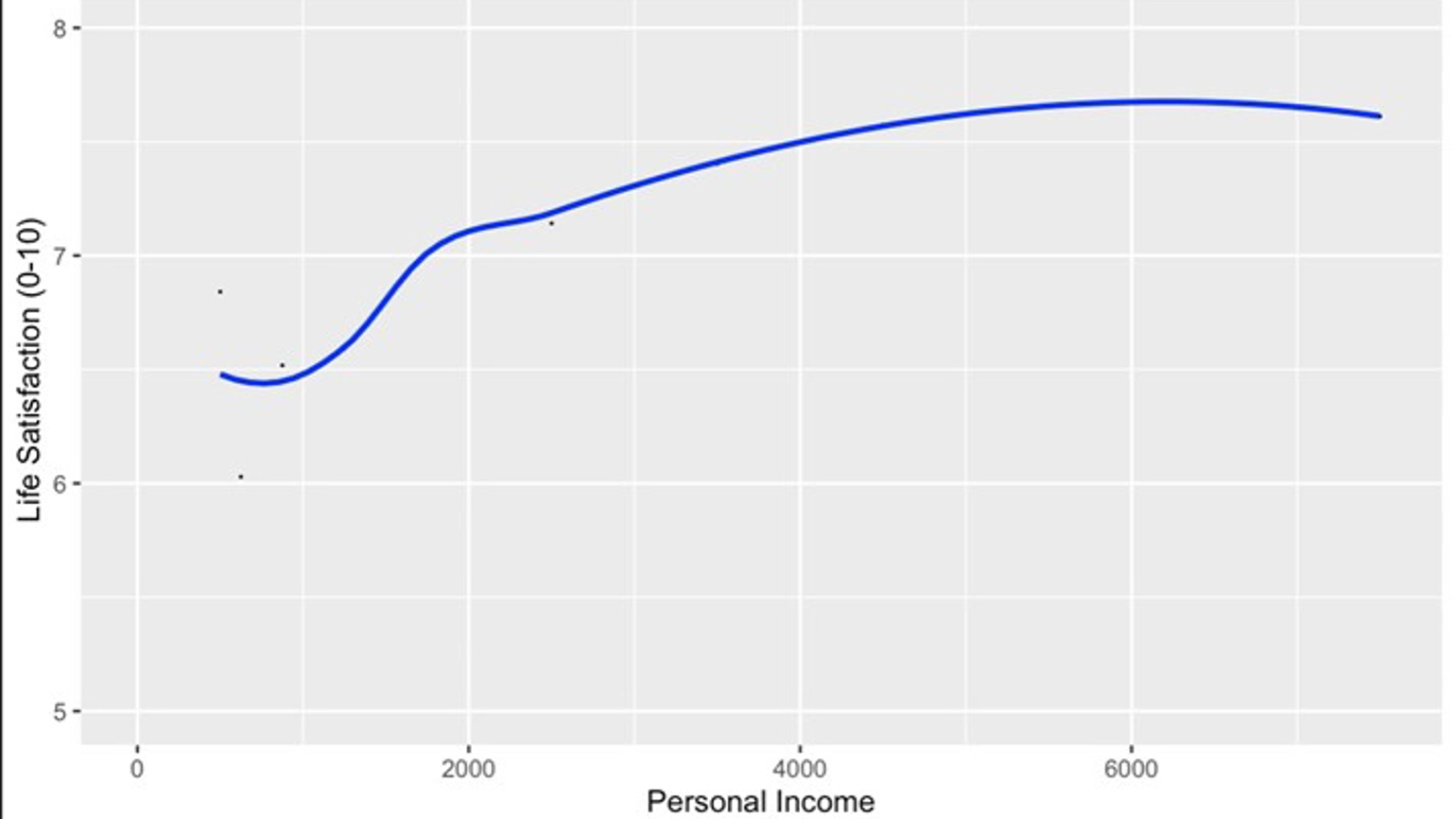

A key factor of happiness in retirement is financial status. But while higher incomes do coincide with greater happiness among retirees, the boost they bring begins to level off as income surpasses about £2,000 a month.

Other factors such as social connections and good health were also vital for people remaining happy as they age, regardless of income. The happiest retirees were also more likely to be satisfied with their day-to-day routines (80% versus 28%), free time (66% versus 25%), relationships with family and friends (70% versus 36%), and social lives (74% versus 23%). They were also much less likely to report severe loneliness (4% versus 18%).

Graph one: Average Life Satisfaction in Retirement per Personal Income

Millions of retirees face unpredictable living costs which threaten their wellbeing

After three years of cost-of-living pain, a significant number of retirees continue to face financial challenges which are likely to impact their wellbeing in retirement.

More than one in four people in retirement (27%) find that their finances are unpredictable and hard to keep track of, while one in five retirees have found themselves unable to meet the costs of housing (18%), food shopping (20%) and utilities (21%). Almost one in 10 (9%) are struggling to meet these costs on a regular basis.

Additionally, a third of retirees (34%) have found that financial constraints hinder their ability to socialise, potentially exacerbating loneliness which can further impact their wellbeing.

Separate research3 by the provider, shows there is a sense of excitement about the freedom that comes with retirement, but also a worry about financial security.

Legal & General wants to see improved incomes for the next generation of retirees

Young people at the start of their pension saving journey, retiring sometime in the late 2060s would need an income of £77,1454 to reach the satisfaction levels of today’s happiest retirees. To achieve this, the average person along with their employer would need to set aside nearly 10% (up from the current 8%) of their qualifying income every month, from the age of 22 until retirement.

But this assumes the saver has not had a career break and owns their own home. For the average person, the reality is that the contribution rate will need to be higher as many people will need to compensate against career breaks or periods of reduced income (i.e. for caring responsibilities). Renters who do not have property wealth to fall back on could need to contribute up to 21%.

Legal & General is exploring further solutions that will increase minimum workplace contributions over time to a level that will provide members with an adequate income in retirement.

Lorna Shah, Managing Director, Retail Retirement: "Our collaboration with the Happiness Research Institute aims to give us a greater understanding of what people truly need to be happy in retirement, so that they can maintain and even improve their wellbeing as they get older. While strong social connections and good health play a vital role in a rewarding retirement, the study shows having a predictable income is key to unlocking the other elements of life that make us happy.“Young adults today need more support to help them save and secure a more rewarding retirement in the future; a key step in achieving that is an increase in workplace pension contributions. We should also consider the role that other assets, such as property, might play in helping people supplement their pension pots.”

Meik Wiking, CEO, Happiness Research Institute: “The study shows that money does indeed matter for happiness. In fact, money plays a crucial role. Being without sufficient resources to make ends meet causes worry and stress and a lower quality of life for people in the UK. That is especially the case for people in retirement. The good news is that there are ways we can improve happiness levels by planning and saving for retirement.”

References

1Analyses were conducted by the Happiness Research Institute on a population-weighted sample of 3,000 UK retirees that responded to a cross-sectional online survey conducted by Opinium in April 2024. The happiest retirees were defined as those with a life satisfaction score greater than the sample median. To estimate average income figures, the middle value of each response option income range was assumed. Multivariate-adjusted regressions were conducted to estimate risk and odds ratios.

2Calculations are based on the following assumptions:

• CPI inflation = 3%

• Age-related and gender specific salary premium assumed based on Office of National Statistics Annual Pay data from the Annual Survey of Hours and Earnings

• Salary increase = 3% + salary premium as described above

• Base assumption that a member will start saving into a workplace pension at age 22, retiring at age 67, with no break in contributions

• Investment return on pension pot, assuming broad 60/40 asset split, (6.7% p.a.)

• Qualifying earnings – Currently (£6,240 to £50,270), Future years (increased annually by CPI assumption)

• Assume the member takes their tax-free cash on retirement and a full state pension

• Figures quoted are post tax

• Estimated income based on current open-market annuity rate of 20.4, available at https://www.hl.co.uk/retirement/annuities/best-buy-rates. Single life, RPI indexation with a 5-year guarantee assumed

3Legal & General customer segmentation data, 2024.

4The £77,145 figure takes the current "ideal" value of £20,400 and assumes inflation of 3% p.a. over 45 years to get a value in 45 years’ time (i.e. 22-year-old retiring at age 67), assuming nothing else changes.

Further information