L&G Research: Sustainable and impact mandates expected to account for nearly half of UK institutional investors’ private markets portfolios in the next two years

Legal & General (‘L&G’) has today published its latest research on UK investor sentiment towards private markets allocations. The study explores how 150 institutional investors are planning their future private markets portfolios, highlighting key allocation drivers and the increasing importance of impact and sustainability mandates.

21 Nov 2024

Full press release

- Legal & General (L&G) publishes comprehensive study of UK institutional investors’ attitudes to private markets investing, encompassing the views of 150 DC, DB, LGPS, Insurance, and

- Charity investors totalling over £7.6trn in assets under management.

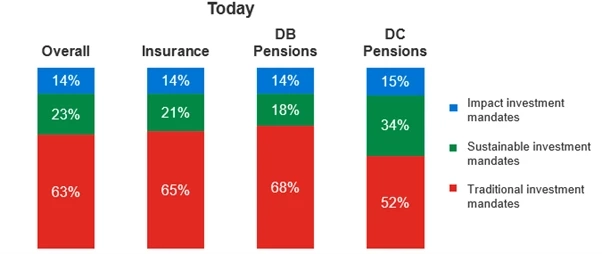

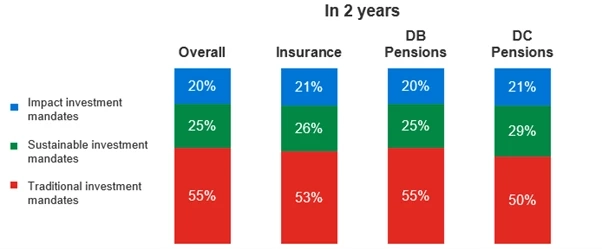

- L&G’s research found that impact and sustainable mandates are expected to account for nearly half (45%) of private markets portfolios in two years’ time, up from over a third (37%) today.

- Asset owners believe they can achieve greater social (61%) and environmental (55%) outcomes through private markets.

The research1 highlights that investors see a clear alignment between commercial returns and the societal and environmental outcomes they are prioritising. With impact and sustainable mandates rising in prominence, a strong majority of asset owners are currently prioritising environmental (77%) and social (75%) outcomes in their private markets portfolios, and this trend is set to accelerate over the next two years.

Of the client segments surveyed, Defined Contribution (DC) pensions schemes are expected to have the greatest number of impact and sustainable mandates, representing a total of 50% of private portfolios in two years. This is closely followed by insurance investors at 47% and Defined Benefit (DB) pension schemes at 45%.

Environmental and social priorities

Over three quarters (81%) investors said that clean energy & tech and renewable energy infrastructure were the top environmental outcomes they’re prioritising, identifying these sectors as providing the biggest investment opportunities in the near future. This is followed by sustainable transport (46%), and sustainable property / real estate (36%).

Economic infrastructure (52%), health and social care (43%), and affordable housing (41%) are the social outcomes that are highest on investors’ agendas within private markets. Additionally, over half (57%) of DC investors said life sciences was a top priority among social issues, alongside healthcare outcomes (53%). In contrast, economic infrastructure (49%) and affordable housing (41%) are the top social outcomes for Corporate DB schemes.

Strongest return opportunities

When surveyed on the most attractive thematic trends to target via private markets, almost three-fifths (59%) of respondents said the climate transition and decarbonisation.

As a result, institutional investors are seeking to increase their allocations to the following sectors in order of priority: infrastructure, private equity/venture capital, private credit, and real estate. 53% of those surveyed plan to increase allocations to infrastructure over the next two years, with 43% set to also increase private equity and private credit.

DC schemes are prioritising transmission assets and network resilience to a greater extent than other investors, with 47% citing this as a priority area. Whereas, LGPS are the most likely cohort to see nature-based solutions as offering the best return opportunities (20% compared to DC at 17% and insurers at 11%).

Bill Hughes, Global Head of Private Markets, L&G Asset Management: “As we set out earlier this year, our ambition is to expand our global Private Markets platform, giving clients access to a breadth of investment opportunities, particularly in private credit, real estate, infrastructure, and venture capital. This research confirms that investors are looking to increase their allocations to private markets for the potential increased returns they can deliver and also for their sustainability and impact characteristics.”

Christy Lindsay, Head of Private Markets Distribution, L&G Asset Management: “This research allows us to gain a comprehensive overview of the opportunities and challenges institutional investors face in allocating within private markets. In our view, this can only grow in importance as a result of changing market and regulatory dynamics. As a long-standing investor in many of these critical sectors, we are well placed to help clients navigate their future private markets allocations.”

References

1Research undertaken by CoreData in August/September 2024 across 150 UK institutional investors.

Further information