- DB/Final Salary pension schemes de-risking -buy-ins, buy-outs, longevity insurance

- Alternative de-risking solutions – APP, ISS

- Pension scheme administration

- Re-insurance

(UK, USA, Canada, Bermuda and Ireland)

Legal & General agrees second bulk annuity transaction with Triplex Lloyd Final Salary Plan

c£75m buy-in follows a c£175m buyout in 2018 with the same scheme

28 Jan 2022

Full press release

Legal & General Assurance Society Limited (“Legal & General”) today announces that it has agreed a c£75 million bulk annuity transaction for the Doncasters Section of the Triplex Lloyd Final Salary Plan (“the Plan”), securing the benefits for around 300 deferred members and 800 retirees.

Today’s announcement marks Legal & General’s second transaction with Doncasters Limited (“the Sponsor”), following a c£175 million buyout completed for the Triplex Section of the Plan in 2018, which covered over 600 deferred members and 1,400 retirees. The transactions cover two different sections of the Plan, which is now fully insured.

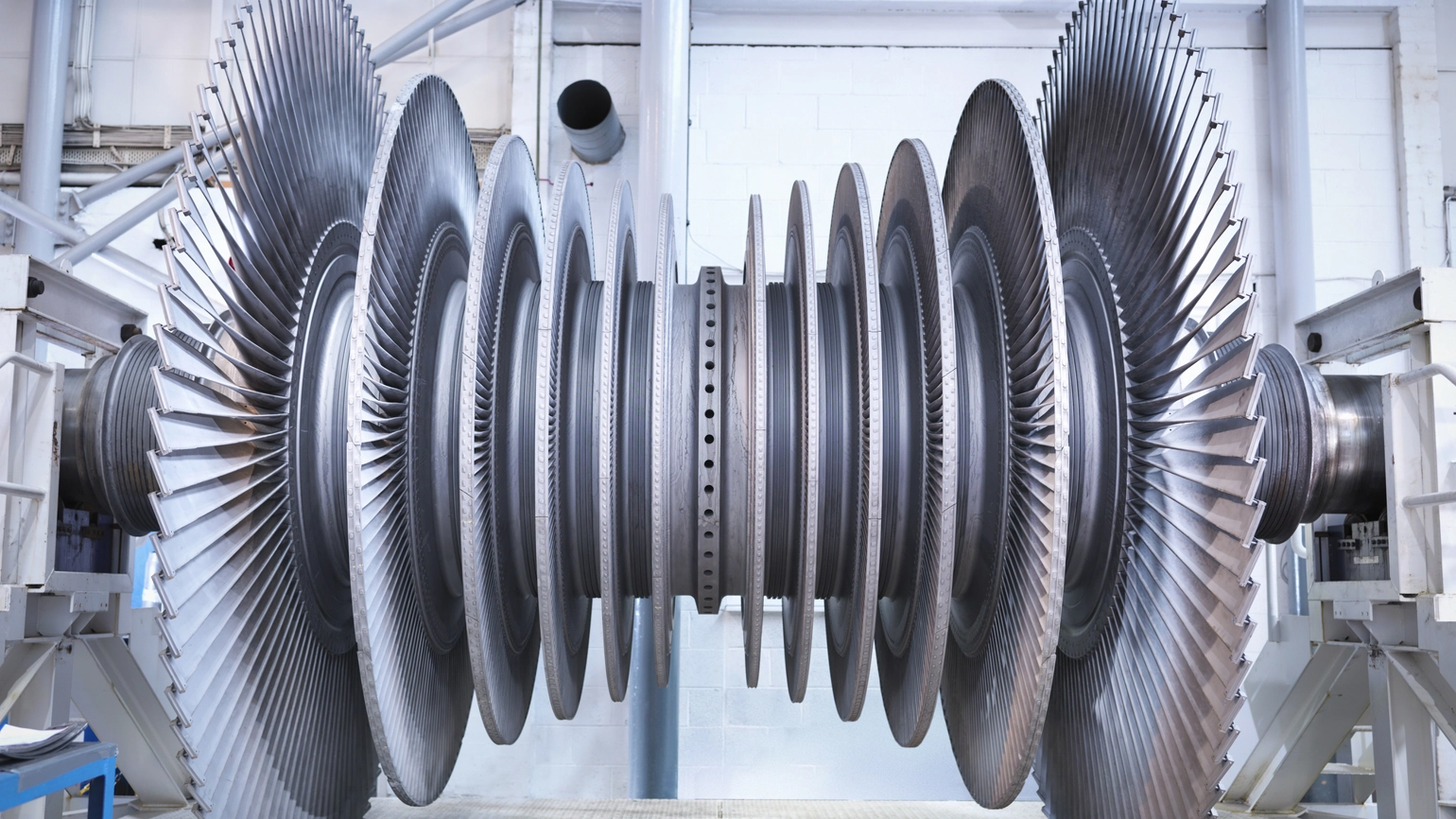

The Sponsor is a leading international manufacturer of high-precision alloy components for aerospace, industrial gas turbine, specialist automotive and petrochemical markets.

The Plan was an existing client of Legal & General’s investment management business (“LGIM”), which enabled the Trustees to price-lock the LGIM invested funds, ensuring price certainty when favourable market conditions arose.

The Trustees were advised on the transaction by XPS and legal advice was provided to the Trustees by Burges Salmon.

Adrian Somerfield, Director, Legal & General Retirement Institutional "Long-term trust and partnership are the foundations of our business, and we are delighted to have worked over the years, and across Legal & General, to help the Trustees of the Triplex Lloyd Plan achieve their de-risking objectives. Working with the Trustees we have now been able to provide security for over 3,000 scheme members.When the Plan moves towards buyout, our in-house client service team will proceed towards welcoming all their members as Legal & General pension policyholders.”

For further information: