As 2024 began, we welcomed António Simões as our new Group CEO. After spending the first half of the year taking a deep dive into our business and listening to our investors, customers, partners and employees, he outlined his new vision for Legal & General in June.

Our new strategy set out ambitions for sustainable growth, sharper focus and enhanced returns, and a vision of becoming a growing, simpler, better-connected L&G.

Read on to find out how that all came to life for us in 2024.

January

LGIM (which became part of our new Asset Management in June) completed a £25 million transaction with The National Trust. We’re helping it fund next-generation hydro-electric and solar generation projects across its estates. That’s key to the Trust achieving Net Zero by 2030.

This investment is a great example of our commitment to helping our clients reach net-zero greenhouse gas emissions by 2050 or sooner. That’s driven by our conviction that few issues are as significant to both our environment and society, and to investment returns, as climate change.

February

February was a month of growing investments. Our total investment with Jigsaw Homes Group reached £125 million – we’re working with it to deliver over 4,000 new social and affordable homes by 2028. And we helped inject more equity into ECF. ECF is a unique partnership between three of the UK’s leading regeneration and investment organisations – Homes England, Muse and of course, us.

ECF now has a £400 million capacity, which will help it create high-quality urban environments that reflect the priorities of local communities. These milestones represent our commitment to growth that both supports communities and sustains shareholder value.

Meanwhile, António’s mission to listen, listen, listen took him both across and beyond the UK. He spent his second month meeting colleagues by the seaside in Hove, in the heart of Wales and over the Atlantic in Maryland.

March

Our 2023 annual report showed the strength of our businesses in challenging market conditions, as they achieved record new business volumes and resilient operating profit. Building on this success, we were named Britain’s Most Admired Company for the second year running, which António celebrated at the London Stock Exchange, who sponsor the award.

And we reached an exciting milestone in our £4 billion partnership with the University of Oxford. A joint £59 million building project concluded with the handover of two significant new research and innovation buildings at Begbroke Science Park.

This month we also brought our most senior leaders together at Battersea power station for the first quarterly senior leader event. This was a great opportunity to build connections, create shared understanding of what the year might hold, and to hear from the GMC and António about their ambitions.

April

Legal & General Affordable Homes announced its first net-zero carbon homes to be developed in partnership with Rose Builders. They’ll support lower carbon emissions and operational energy use, in alignment with their sustainability goals. This milestone represented a step toward greener affordable housing solutions, contributing to our broader environmental targets.

LGIM published its Active Ownership annual report, detailing its Investment Stewardship Team’s 2023 activities. Looking back, the team cast 149,000 votes at 15,580 meetings, to help drive long-term, systemic change on environmental, social and governance-related risk factors. Engagement on behalf of clients to drive to deliver sustainable value has continued through the whole of 2024, with engagement focused on its six ‘super themes’, focusing on Climate, Nature, People, Health, Governance and Digitisation.

May

Since the pandemic, the UK’s contended with record levels of long-term sickness and strained public health resources. And there’s always been a correlation between economic deprivation and general poor health. Businesses have a role to play in tackling both. To lead the way, we partnered with the UCL Institute of Health to launch our £3 million Health Equity Fund. It will address the social causes of poor health in up to 150 UK communities.

We also completed our third and final buyout of the Nortel Networks UK Pension Plan. Since our first involvement with the Nortel plan back in 2009, we’ve insured £2.5 billion of its liabilities.

June

June marked several milestones for our business and its wider communities.

António announced our new business strategy at Capital Markets Day, signalling our far-reaching ambition to grow and evolve, and making fresh commitments to invest in our business and reward our shareholders.

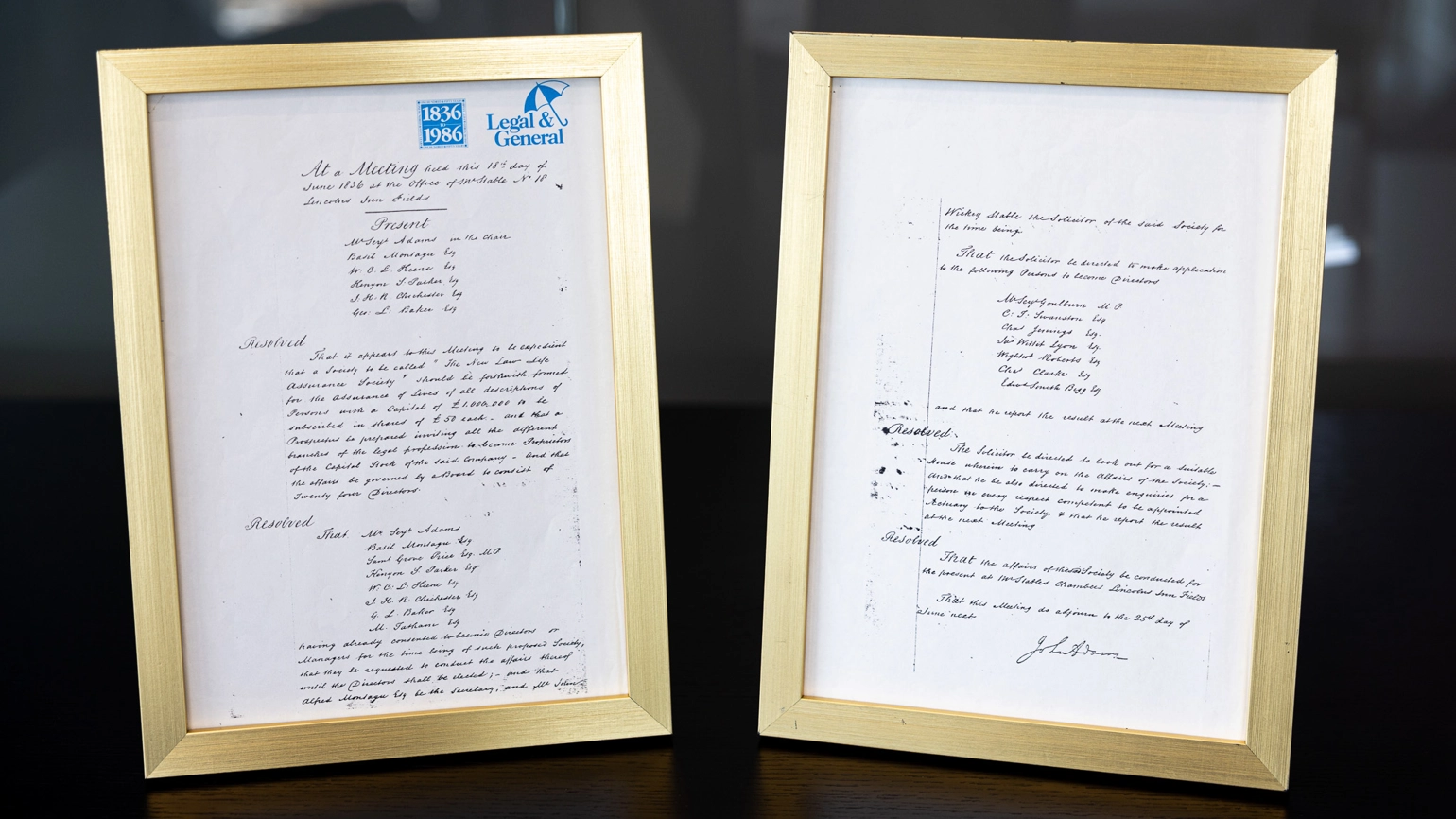

We celebrated our 188th birthday on the 18 June. You can see the original handwritten minutes of our first board meeting in 1836 (see photo). Both we as a company and the society we’re part of have come a long way since then!

LGIM launched its eighth Climate Impact Pledge report, which this year introduced new baseline expectations on methane emissions disclosure and thermal coal generation capacity while announcing that both UK listed mining company Glencore and TJX (US multinational and owner of TK Maxx would be added to the Divestment list and removed from L&G Future World Fund ranges.

We all took a little time to reflect, giving thanks to the generations of colleagues who helped build the legacy we all share today. And we’re just as grateful to each other now - all 11,500 of us, who have inherited that legacy and are evolving it for the future.

Adding to the celebrations, L&G Retail’s award-winning A Little Bit Richer podcast hit 100,000 downloads and over the past year our TikTok channel had 8.9m video views and reached an audience of 6m. We also flew our multi-coloured umbrella at Pride celebrations across the UK!

July

Not wasting any time bringing our new strategy to life, we announced the launch of the L&G Private Markets Access Fund at the London Stock Exchange. It lets our 5.2 million defined contribution members access diversified private markets. That includes investment opportunities like clean energy, affordable homes, university spin-outs and critical infrastructure. We think it’ll drive greater pension engagement from our members – and of course it’ll support forward-thinking investments too.

July was an important month for our affordable housing mission too. We both acquired 390 shared ownership homes from Orbit Group and launched a new fund to deliver affordable houses across England. For the latter, we secured £125m from the ACCESS pool, showcasing our combined commitment to creating much-needed affordable homes.

August

We started August by announcing our half year results, which reflected the ongoing strength of our business, with core operating profit slightly ahead of the prior year and a solvency coverage ratio of 223%.

Also released this month, our ‘Bank of Family’ research showed that family contributions are becoming increasingly essential for property purchases and support has reached record levels in 2024, helping 335,000 UK property purchases with £9.2 billion worth of lending.

August brought some more successful steps towards addressing our national housing shortage and creating affordable homes for communities in need. We secured £120 million in affordable housing investment from the Greater Manchester Pension Fund and grew our partnership with Anchor to £100 million, supporting another 5,000 new affordable homes over the next decade.

September

As autumn began, we continued to show progress on our new strategy with the sale of CALA Group, simplifying our portfolio to enable a sharper focus on our core, synergistic businesses.

We brought our transformation into the physical world, announcing our move from our current One Coleman Street home to the iconic Woolgate building at…ten Coleman Street! Above you can see António pointing out our new office, just over the way from our current one. The move is more than just a change of address. It’s an investment in a future-ready workspace that aligns with our commitment to sustainability and innovation.

September was a busy month, and we also announced several changes to our Group Management Committee. We announced that Eric Adler will join as Chief Executive Officer of Asset Management in December to spearhead growth plans.

Other changes include Laura Mason, currently CEO, Private Markets, being appointed as Retail’s next CEOand Katie Worgan joining from Lloyds Banking Group in the newly created role of Group Chief Operating Officer. These appointments further strengthen our leadership team as we pursue our ambitious growth strategy and become a simpler, better-connected business.

We’ve also kept on helping others find new homes too. This month we announced a partnership with NEST, backed by £350 million in combined investment, to build high-quality rental homes – an exciting opportunity for NEST’s members. This initiative meets critical housing demand and supports the government’s target of 1.5 million new homes, while also extending a valuable investment opportunity to our members. That strengthens both the rental market and our shared future.

Finally, we wanted to give Muslim members to have a wider choice of Shariah-compliant investment options. So we announced the launch of a new Islamic Investment Proposition. It builds on our strong track record of innovative solutions that improve outcomes for our members.

October

October saw us take a pivotal step in our growth journey with a strategic investment in Taurus Investment Holdings. It accelerated our progress and strengthened our expertise in US real estate. We also committed up to $200 million extra seed capital, reinforcing the strength of our combined capabilities and our belief in the exciting growth prospects we’ve unlocked.

This month we also partnered with the Happiness Research Institute. We calculated the exact amount of money that you need for a happy retirement and discovered that the happiest retirees have £222k in their pension pot. Armed with this knowledge, we are exploring further solutions that will increase minimum workplace contributions over time to a level that will provide members with a good income in retirement.

The month ended with our £1.1 billion full buy-in with the Deutsche Bank (UK) Pension Scheme. It built on our successful partnership and marked the end of the DB (UK) Pension Scheme’s de-risking journey.

November

Our momentum kept us rushing towards the end of the year with no signs of slowing down.

We reaffirmed Legal & General’s ‘Future Places’ mission by announcing the creation of the UK’s first new-build independent neighbourhood. It will offer over 25 independent retailers their first year rent-free in efforts to breathe life into the high street and champion independent businesses and entrepreneurship.

And we completed a £34 million buy-in with Walkers Shortbread Limited Retirement Benefits Scheme, securing the benefits of 161 retirees and 238 deferred members. We managed it through Legal & General Flow, a tailored buy in/out solution for smaller pension schemes.

This month we also took some time to celebrate our people. We gathered at the Natural History Museum in London for our L&G Annual Awards 2024, a special event to celebrate the individuals and teams who go above and beyond to make a difference—whether it’s delivering exceptional service to our customers, driving innovation, or being a leadership role model. This was a great reminder of the power of teamwork, commitment, and excellence in everything we do and how important our people are to delivering on our ambitious strategy.

December

As the year draws to a close, we are celebrating not one, but two records!

Our annuity sales have reached an all-time high of £2 billion so far this year, indicating more of our customers are looking for financial stability and peace of mind.

2024 was also a great year for our Institutional Retirement business in the US, with $2.2 billion of Pension Risk Transfer (PRT) business in the US, making this year its largest year on record in the US market. As the only direct writer of PRT across the UK and US, and with a growing presence in the Canadian market, these successes demonstrate continued progress against our refreshed growth strategy and exemplify our disciplined approach to profitable growth in international markets.

Continuing the conversation about our strong position in the PRT market, we held our Institutional Retirement Deep Dive event in December.

Our pipeline of PRT deals is as strong as it has ever been and our guidance of £50-65bn of UK PRT (2024-2028) remains unchanged. Year-to-date we have written global PRT volumes of £10.0bn and are exclusive on a further £0.5bn expected to close in 2024.

This year has seen us make good progress in delivering on the strategy set out at the Capital Markets Event in June and 2025 looks to be just as busy!